Energy from Waste: the solution to Australia’s war on waste?

04 February 2021

Following the Council of Australian Governments (COAG) Waste Strategy Response announced in 2020, Energy from Waste (EfW) technologies have emerged as potentially viable methods of managing waste in Australia, supporting the Australian government’s aim to become a completely circular economy over the coming decades.

This emerging sector undoubtedly brings significant political, economic and regulatory challenges, but also opportunity for investors, industrialists and even the National Electricity Market with a new source of clean baseline energy production (where the input is Australia’s waste).

Below, we explore the EfW opportunity and discuss what needs to happen on a policy and regulatory level for broader commercial uptake and investment into the sector.

What is Energy from Waste?

While EfW incorporates any technology or process that converts ‘waste’, defined as any kind of waste that would otherwise go to landfill or be exported, into energy or energy carrying products, for current purposes we are primarily focused on thermal processes (combustion, gasification and pyrolysis).

Combustion and gasification differ. Combustion burns the waste with the resulting heat converting water into steam and then electricity; while gasification uses oxygen or steam reactions that cause the waste to convert into a gaseous mixture. This mixture has applications beyond electricity and can also be converted into products such as diesel fuel, hydrogen fuel or ethanol.

Large scale EfW facilities commonly use combustion for the thermal treatment of mixed waste streams (such as municipal solid waste). Gasification requires more homogenous waste streams or pre-treatment before the waste enters the gasification chambers.

Pyrolysis is the heating of organic material, such as biomass, in the absence of oxygen. The process produces three products: biochar, bio-oil and bio-gas, each with a range of potentially useful applications. Pyrolysis can be used for the treatment of organic wastes, including plastics, and may be deployed on a smaller scale and in a broader range of locations than large scale combustion and gasification processes.

Is Energy from Waste a commonly accepted technology?

The EfW sector has struggled to gain traction in Australia for a number of reasons:

- Australia’s abundance of land in close proximity to major cities and waste producers is perfectly suited to cheap landfill operations. Coupled with an inconsistent approach to waste levies, there is little to no incentive to consider alternatives to landfill such as EfW which are more capital intensive.

- EfW plants have traditionally been regarded as smelly, undesirable projects that no one wanted in their backyard. This has led to strong opposition from communities situated near proposed projects, despite new technologies being developed for emission capture and smell mitigation.

- EfW projects have struggled to explain their importance to the circular economy, in that EfW plants allow for the recovery of energy from residual or non-recyclable waste that would otherwise be sent to landfill.

- There has been a lack of coordinated policy and regulation. Nationally consistent policy and regulation which embed the waste management hierarchy reflect the latest EfW technologies and emission limits, and support offtake markets that would facilitate project development by investors on a national basis.

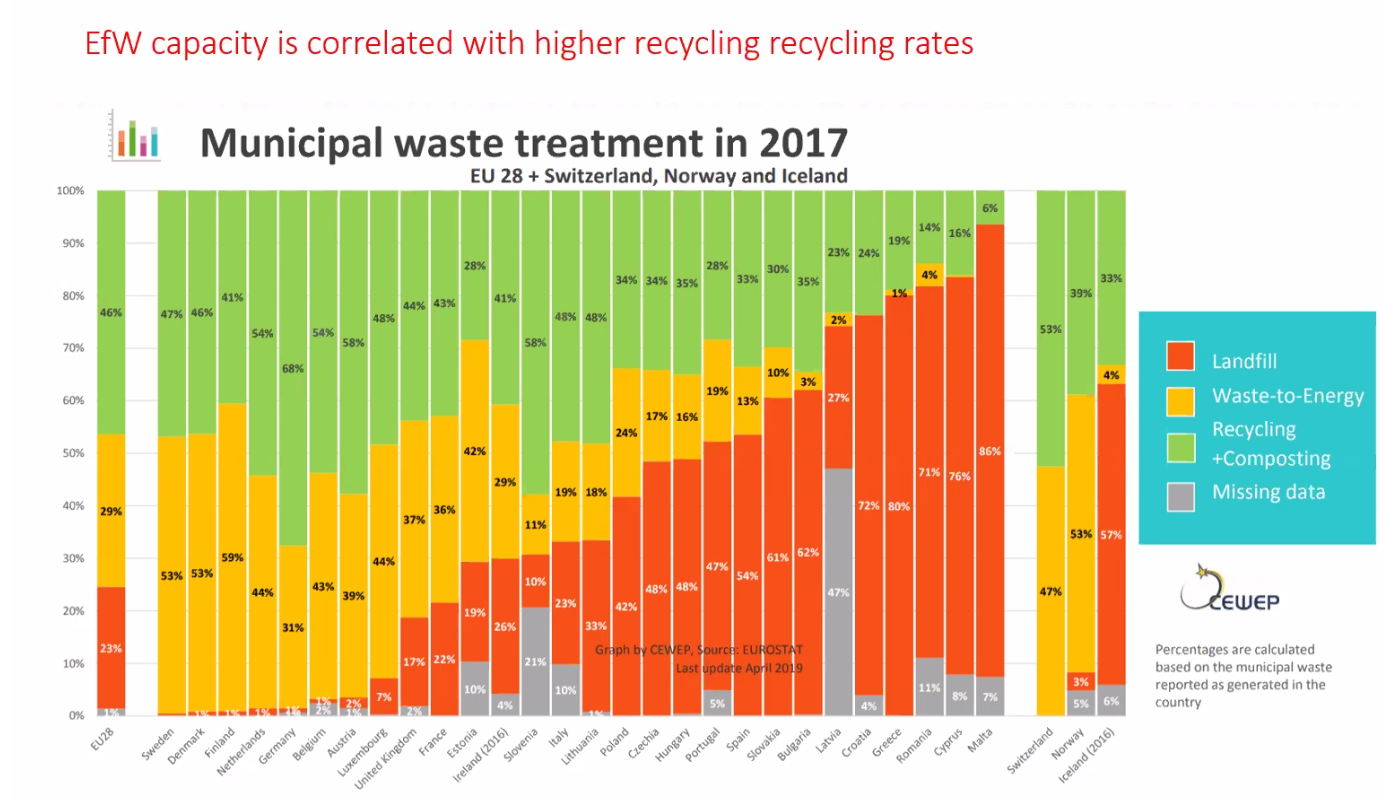

Whilst Australia has faced a general lack of any substantial investment into EfW projects, the sector in other parts of the world, such as Europe, Japan and the United States, has proven to be highly successful both from a commercial and waste management perspective. In particular, case studies in Europe have shown that when a country has adopted EfW technology its recycling rates have also improved, provided the correct regulatory environment and incentives are put in place.[1]

Confederation of European Waste-to-Energy Plants, Latest Eurostat Figures: Municipal Waste Treatment 2017 - Municipal waste treatment in 2017.

Why did Europe adopt Energy from Waste?

There are several key factors behind Europe’s adoption of EfW technology. The first is necessity. With limited land available and strong population growth leading to increased waste, an alternative to landfill had to be found. The second is environmental concerns. Individuals in Europe, in particular the relatively wealthier Western European nations, were early movers in voicing their concern over climate change and the importance of mitigating future damage. As a result political support followed for technologies such as EfW.

Despite the inductive conditions for EfW in Europe, at its early stages the adoption of EfW technology still required a supportive and consistent policy and regulatory approach between the various levels of government in each country to support the development of the sector at a broader European Union level.

At an individual country level, the countries who have found the most success with EfW, such as the Netherlands, were early adopters of a uniform country-wide waste levy. This helped standalone EfW projects become more economical for private investors. With a pricing incentive in place, countries then developed regulatory and technical standards, which continue to be updated to account for evolving EfW technologies (albeit at an European Union level). For example, in December 2019, the European Union released the Best Available Techniques (BAT) Conclusions for Waste Incineration under Article 13(6) of the Industrial Emission Directive (IED). The document contains 37 BAT conclusions which seek to reduce emissions from waste incineration and to better improve EfW’s position in the circular economy and waste management hierarchy.[2]

The European Union regulatory framework, which regulates over 400 EfW plants currently in operation in Europe, consists of:

- the EU Landfill Directive;

- renewable heat incentives;

- landfill levies/taxes;

- feed-in tariffs; and

- legal requirements under the IED.

What else is required for Energy from Waste to be successful?

Europe’s experience with EfW shows that critical to the economics of each proposed project is a stable and long-term supply of waste. Local councils often coordinate and combine their waste quantities to support the development of large scale EfW projects. To minimise transportation of waste, projects are often located close to the major sources of waste, for example cities for their municipal waste or large industrial emitters of waste. However, and as mentioned, this creates a tension with the local community.

The community opposition could be avoided by locating EfW plants in regional locations and away from residential homes, but this has two disadvantages:

- first, the additional cost of transporting waste out of cities will make EfW less competitive compared to landfill and would require a greater waste levy to redress the balance; and

- second, projects require a ready and easily accessible market for their electricity and other end products.

With respect to other end products, while in northern hemisphere countries the heat generated by a EfW plant can be used for district heating, in Australia it is more likely that heat will be used by industry for manufacturing processes, utilised in greenhouses for agriculture purposes or could be turned into cooling systems for residential or commercial use.

Other by-products, such as syngas, char and oils, can also be sold as additional sources of revenue rather than sent to landfill as an additional cost.

Separately, while historically the process of converting waste to energy produced substantial carbon emissions as a by-product, modern technologies have largely removed this negative consequence. For example:

- Under a nationalised approach, the Netherlands’ EfW plants are equipped with extensive flue gas cleaning to reduce dioxins and acid emissions.

- Advancements in EfW technology mean that a portion of the electricity produced from EfW plants in Europe is deemed to be renewable energy.

- EfW plants can supply greenhouses with CO2 to promote plant growth. Dutch EfW company, AVR, has implemented this strategy in an effort to reduce its emissions from incineration.[3]

What does Australia’s Energy from Waste sector currently look like?

Australia does not yet have any large scale operational EfW plants. However, a strong pipeline of EfW projects is emerging with two plants currently under construction in Western Australia and a number of others around the country in the process of obtaining finance and regulatory approvals. Announced projects include the following.

- Avertas Energy (Kwinana, WA): The Avertas Energy Plant, currently under construction, is on track to be Australia’s first thermal EfW plant with operational status expected to be achieved this year. The circa $698 million plant was co-developed by Macquarie Capital and Phoenix Energy, with investment from DIF Capital Partners and funding from the Australian Renewable Energy Agency. Acciona has been appointed to design and construct the facility and a 25-year operations and maintenance service agreement has been signed with Veolia. When completed, the plant will be capable of converting up to 400,000 tonnes of household, commercial and industrial waste (a quarter of Perth’s annual post recycling waste), which would otherwise be headed for landfill, into electricity and construction materials.

- East Rockingham (Perth, WA): The circa $511 million East Rockingham Resource Recovery Facility is the second EfW project to reach financial close in WA. The project was co-developed by Hitachi Zosen Inova (HZI), New Energy Corporation and Tribe Infrastructure with additional investment from Masdar (a subsidiary of Mubadala Investment Company) and John Laing, and funding from the Clean Energy Finance Corporation and the Australian Renewable Energy Agency. The contract to design, build and commission the plant was awarded to an EPC consortium of Acciona and HZI, and long term operation and maintenance has been awarded to SUEZ. On current estimates, the plant could divert up to 300,000 tonnes of waste from the Cockburn, Belmont, Kalamunda, Mundaring and Swan landfills each year.[4]

- Maryvale EfW Plant (Latrobe Valley, VIC): Opal Australian Paper is developing a circa $600 million EfW plant with SUEZ at the Latrobe Valley mill. Late last year the project secured additional equity partners in Masdar and Tribe and selected Acciona as its construction partner. SUEZ has committed to supply the plant with a significant portion of its waste requirements.[5] The consortium has also announced a Memorandum of Understanding with Citywide to source and supply waste via the rail link between Melbourne and the mill.

- Melbourne Waste and Resource Recovery Group Advanced Waste Processing Project (Melbourne, VIC): In early 2020, the Metropolitan Waste and Resource Recovery Group commenced the largest tender for new waste management infrastructure ever undertaken for Melbourne councils to provide an alternative to landfill for 16 councils in Melbourne’s south east. Three tenderers were shortlisted and are now working towards the final tender stage with a 20-25 year contract expected to be awarded in 2022. Construction is targeted to commence in 2023.[6]

- Western Sydney Energy and Resource Recovery Centre (Sydney, NSW): Cleanaway has recently completed the public exhibition phase of the planning process for its proposed $500 million EfW plant in Western Sydney. The project is being developed by Cleanaway and Macquarie Capital and will be the first of its kind in New South Wales, designed to process up to 500,000 tonnes of waste materials and generate up to 55MW of electricity. The project would contribute to the achievement of the NSW Environment Protection Authority’s target of diverting 75% of waste away from landfill.[7]

- Mt Piper Energy Recovery Project (Lithgow, NSW): Energy Australia, in collaboration with Re.Group, is developing a $170 million EfW plant that will connect to the Mt Piper Power Station near Lithgow to create additional energy from ‘refuse derived fuel’ (RDF) made from non-recyclable household and commercial waste.[8] The project would divert 200,000 tonnes of waste away from landfill and make the Mt Piper Power Station the first hybrid coal/RDF power station in Australia.[9]

- Remondis Waste to Energy Facility (Ipswich, Qld): Remondis is in the process of obtaining environmental and regulatory approvals for its circa $400 million EfW plant in Swanbank, west of Brisbane. The plant will process up to 500,000 tonnes of waste per year and generate up to 50MW of electricity. Construction is targeted to commence in 2024.[10]

- Renergi Biorefinery (Collie, WA): Renergi, a spin-off from Perth’s Curtin University, has received ARENA funding to design, build and operate a commercial demonstration pyrolysis plant in Western Australia. The plant will convert municipal, forestry and agricultural wastes into biochar and bio-oil. The oil produced through the demonstration will be sold as a liquid fuel for local industrial applications, with the biochar to be sold as a soil additive.[11]

With a clear pipeline of Energy from Waste projects, how will more prospective projects become feasible?

Taking lead from other jurisdictions around the world, implementing the following could encourage new EfW projects in Australia:

- A nationally coordinated increase in landfill levies. This is a proven method of facilitating investment into EfW projects as increases in landfill costs incentivise EfW installations.

- Political support. The sector can only develop with a supportive regulatory and political environment which provides investors with a clear understanding of the long term policy and regulation for the sector. Progress is occurring at varying paces amongst the various states and territories and at a national level, the Australian government announced a $1 billion waste and recycling plan in 2020. The key components of this plan are:

- contingent on co-funding from the states and territories, $190 million for a new Recycling Modernisation Fund to leverage private sector investment of up to $600 million;

- $35 million to implement the government’s commitments under Australia’s National Waste Policy Action Plan;

- $24.6 million to improve national waste data so it can measure recycling outcomes and track progress against national waste targets; and

- a commitment to introduce legislation to formally enact the government’s waste export ban and encourage greater product stewardship by the private sector.[12]

- contingent on co-funding from the states and territories, $190 million for a new Recycling Modernisation Fund to leverage private sector investment of up to $600 million;

- The support of the community. The process for obtaining this support will require public discussion at both a state and local level so that public concerns can be addressed consistently and openly. Despite community concerns, evidence from EfW around the world supports the fact that modern EfW plants lower greenhouse emissions (relative to landfill), encourage increased rates of recycling and create long term jobs.

- Partnerships with local councils (which for the most part manage Australia’s municipal waste) and industrial users. In particular, with advancements in technology there are bespoke opportunities for industrial players to work in partnership with waste management companies to generate energy from their waste as well as profit from any excess electricity that may be supplied to the broader market. The Opal Australian Paper EfW plant is a prime example of this emerging opportunity.

Globally, EfW projects are expanding as jurisdictions implement the necessary regulatory framework and contractual mechanisms needed to facilitate growth in EfW technologies. In Australia, renewed political commitment to developing and investing in circular economy waste infrastructure and technology is a strong indication of the political support for the further development of the EfW sector. EfW, if used appropriately within the waste management hierarchy, can become a key part in the circular economy as it does not detract from recycling, diverts waste from landfill, reduces environmental and social impact, and provides additional, low emission, baseload electricity from waste which would otherwise end up in landfill.

[1] Confederation of European Waste-to-Energy Plants, Latest Eurostat Figures: Municipal Waste Treatment 2017 - Municipal waste treatment in 2017.

[2] Best Available Techniques (BAT) Reference Document for Waste Incineration: Industrial Emissions Directive 2010/75/EU (Integrated Pollution Prevention and Control),

[3] AVR, Waste-to-energy company tackles CO2 emissions with large-scale CO2 capture installation (29 May 2018).

[4] ‘Government of Western Australia, Media Statement, Nations second waste-to energy plant to be built in WA (24 December 2019).

[5] Renew Economy, Maryvale Energy from Waste project moving forward (20 October 2020).

[6] Smarter Solution, Shortlisted companies announced in the search for alternatives to landfill (7 October 2020).

[7] Cleanaway, Why energy from waste for Western Sydney? (10 July 2020).

[8] EnergyAustralia, Study shows potential energy recovery project a boost for Lithgow (17 January 2020).

[9] Re.Group, Mt Piper Energy Recovery Project.

[10] Remondis, Swanbank Clean Energy and Resource Recovery Precinct.

[11] Renergi, Biorefinery.

[12] Australian Government, $1 billion waste and recycling plan to transform waste industry (6 July 2020).

Authors

Tags

This publication is introductory in nature. Its content is current at the date of publication. It does not constitute legal advice and should not be relied upon as such. You should always obtain legal advice based on your specific circumstances before taking any action relating to matters covered by this publication. Some information may have been obtained from external sources, and we cannot guarantee the accuracy or currency of any such information.