The next step towards mandatory climate-related financial risk disclosure: Treasury’s consultation to date

31 August 2023

For some years now in Australia, investors and regulators have been calling for greater consistency, accuracy and transparency in relation to disclosures about climate-related financial risks and opportunities.

Until recently, the Financial Stability Board’s Taskforce for Climate-related Financial Disclosures (TCFD) Framework has been the standard most promoted by regulators like ASIC and ASX for climate-related corporate disclosures, on the basis that TCFD reporting has generally been acknowledged to have led to improved standards of governance and disclosure.

The International Sustainability Standards Board (ISSB) has now taken over the TCFD framework. ISSB has released two disclosure standards:

- one standard for the disclosure of sustainability risks; and

- the second standard for the disclosure of climate-related financial risks (Climate Standard) and opportunities (which incorporates the TCFD Framework).

From 2024, the ISSB standards will start being applied globally by organisations.

ASIC has stated that companies are required to make climate-related disclosures in a company’s operating and financial review under section 299A(1)(c) of the Corporations Act where climate risk is a material issue that could affect achievement of the company’s financial performance. However, there remains very little in the way of mandatory regulation of climate risk disclosure in Australia for reporting companies.

In December 2022, the Australian Government opened for consultation a proposal for a new mandatory disclosure regime for the reporting of climate-related financial information. The Government sought consultation from various stakeholders on the design and implementation of an internationally aligned Climate-related Financial Risk Disclosure (CRFD) framework (CRFD Regime).

The first round of consultation closed on 17 February 2023 after receiving 194 submissions, including 14 confidential submissions.

A second round of consultation (discussed below) was opened in June 2023.

Review of submissions in response

A review of the public submissions to the first round of consultation indicates:

- Support: 87% of published submissions expressed support for the introduction of the CRFD regime.

- ISSB: the Government asked entities in its consultation paper whether Australia should seek to align mandatory climate-reporting requirements with the global baseline envisaged by the ISSB. Notwithstanding the ISSB reporting requirements are more comprehensive than Australia’s current reporting practices, almost two thirds of published submissions supported the adoption of the ISSB’s climate-related financial information disclosure standards.

- Scope 3 emissions: the National Greenhouse and Energy Reporting Act 2007 (Cth) (NGER Act) imposes the requirement on entities that emit more than 50 kilotons of carbon dioxide equivalent a year to disclose their Scope 1 and Scope 2 emissions. That is, direct greenhouse gas emissions from owned or controlled sources, and indirect greenhouse gas emissions from the generation of purchased energy consumed by company.

Almost 40% of submissions supported a requirement for Scope 3 emissions reporting despite widely acknowledged difficulties in data collection and calculation given such emissions are generated by third parties.

- Liability: disclosure about climate-related risks and opportunities necessarily requires consideration of the future impact of climate change on operations and the use of forward-looking information, especially when disclosing climate scenario analysis.

Consequently, the Government sought consultation on a suitable liability regime proportionate to the inherent risk of disclosing such speculative information. Representations about forward-looking matters are taken to be misleading if those representations are not made on reasonable grounds (see ss to ss 769C and 728(2) of the Corporations Act). The Government consulted on the suitability of the ‘reasonable grounds’ requirement for climate-related disclosures.

Less than 20% of published submissions expressed support for the adoption of a ‘safe harbour provision’ to limit liability when making climate-related forward-looking statements.

Overview of second consultation paper

The Government’s second consultation paper makes a number of proposals on the design and implementation of the CRFD Regime, which can be summarised as follows:

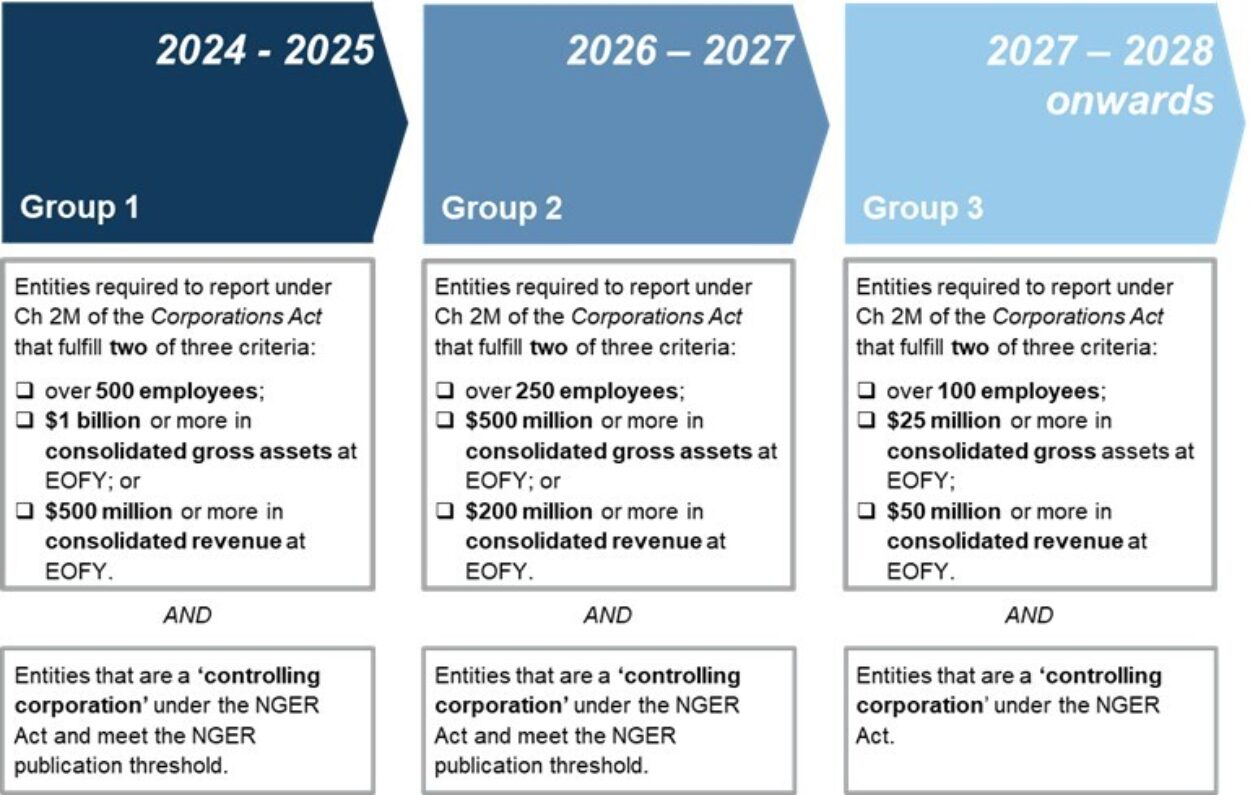

- Coverage: following a phased implementation, entities that meet two of three threshold requirements, or are ‘controlling corporations’ under the NGER Act, will be required to make climate-related disclosures on an annual basis.

The CRFD Regime will apply to private companies that meet certain thresholds. For those entities that are not currently required to publicly disclose their financial reports, climate-related financial information will be required to be publicly disclosed, likely on a company’s website.

- Phased implementation: implementation will be phased over three years to include a growing cohort of entities each year.

In the first year, entities with greater financial capability that are most able to respond quickly or entities that are high-emitting organisations will be required to disclose (see flowchart for more information on the phased implementation).

The CRFD Regime would see an estimated 23,000 entities in Australia reporting climate-related disclosures by the end of the phased timeline.

- Content: the Australian Accounting Standards Board will develop standards in accordance with the ISSB Climate Standard, which requires the disclosure of:

- Material climate-related information (the kind of information that could reasonably be expected to influence the decisions made by the primary users of general-purpose financial reports);

- Governance information (pertaining to an organisation’s governance processes, controls and procedures for monitoring and managing climate-related financial risks and opportunities);

- Strategy (how the organisation identifies and addresses climate-related risks and opportunities);

- Transition plans for managing, monitoring and minimising climate-related risks and opportunities;

- Risks and opportunities (information about how an organisation identifies, assesses and manages climate-related risks and opportunities); and

- Metrics and targets relating to Scope 1, 2 and 3 emissions as well as any relevant industry specific metrics.

- Material climate-related information (the kind of information that could reasonably be expected to influence the decisions made by the primary users of general-purpose financial reports);

- Assurance: assurance will be another requirement under the Disclosure Regime, with limited assurance required initially, moving to reasonable assurance over time.

The second consultation round closed on 21 July 2023.

Key takeaways

The CRFD Regime, as currently proposed, seeks to address the concerns of the investor community regarding accurate and consistent climate-related reporting, and will likely assist the Government’s commitment to meet net zero emissions by 2050.

However, accurate and consistent disclosures under the regime will come with significant challenges for those entities that have not previously been required to report either publicly or to this level of detail with respect to climate-change risks and opportunities.

The phased implementation proposal seeks to require disclosure from entities with appropriate financial resources and capability to quickly adapt and disclose in accordance with the CRFD Regime in the first reporting period. But the inclusion of companies that are not otherwise required to publicly disclose financial information raises interesting policy questions about the purpose of requiring those entities to publish that information, particularly where it may not be utilised by the investment community.

Further, the inclusion of ‘controlling corporations’ under the NGER Act that meet the publication threshold under that regime will inevitably capture entities that are much smaller (in terms of size and capability) than the balance of the first cohort of reporting entities. This may present a significant challenge for these entities. For example, the NGER Act regime requires emissions reporting in October, which may not be aligned with a company’s financial reporting timetable – these entities may have an increased reporting burden and challenges associated with metrics being calculated at different times for different purposes.

The CRFD Regime proposal for ‘assurance’ is premised upon the Auditing and Assurance Standards Board (AUASB) developing auditing and assurance standards for sustainability reporting before the inception of the CRFD Regime. Assuming the AUASB is able to develop these standards in time for the first 2024-2025 reporting year, there may be challenges with meeting the demand for relevant skills and experience amongst professional services firms that will ensure appropriate assurance to entities within the proposed timeframe.

The Government has attempted to alleviate some of the concerns about the risks associated with making forward-looking statements by proposing a safe harbour of three years from the commencement of the regime from private litigant action for misleading or deceptive conduct (and related offences) brought in relation to an entity’s disclosure of Scope 3 emissions, scenario analyses and transition planning.

This safe harbour will not prevent ASIC or the ACCC from bringing actions against entities for misleading or deceptive conduct (and related offences). Whether this measure will instil any confidence in reporting entities to provide full and frank disclosure remains to be seen, especially in light of the fact that Australia now ranks second in terms of having the highest number of climate lawsuits. Despite this measure, reporting entities will still need a high degree of confidence in the data relied upon to disclose Scope 3 emissions, scenario analyses and transition planning information to avoid regulatory action.

How businesses can start preparing for the CRFD Regime

Whether or not the CRFD Regime is implemented in a form that is conceptually the same as what is currently proposed, a mandatory climate-related financial disclosure regime appears to have relatively broad support across industry and is increasingly likely to become reality within the next reporting period.

Businesses can take the following steps to prepare for the regime:

- Read and familiarise yourself with the ISSB Climate Standard to understand the content likely to be required under the CRFD Regime.

This will allow your organisation to identify areas that require attention to ensure accurate reporting, such as in relation to data capture and measuring metrics. Consideration should be given to your organisation’s supply chain and what third-party data your organisation will need to measure Scope 3 emissions in due course. - Identify the capability needs within your organisation to implement the CRFD Regime.

This will be particularly important if your organisation has not previously been required to measure and report emissions data. - Consider engaging professional advisers to assist in conducting a gap analysis exercise.

This will help to identify what steps your organisation will need to take to report in accordance with the CRFD Regime. - Stay informed with the progress of the CRFD Regime.

This includes staying across whether any changes are made to the framework proposed in the second consultation paper. It will also be important to keep your board up to date to ensure that directors are well advised of what the organisation will need to do in order to meet its reporting obligations. Equally, during the implementation of the CRFD Regime it will be important to keep the board informed of the organisation’s climate-related risks and opportunities as directors will need to sign off on disclosures made in the directors’ report. - Deeply understand your environmental footprint.

If the implementation of the CRFD Regime is successful, it is likely that Australia, as a major supporter of the Taskforce for Nature Related Financial Disclosures, will in due course move to also require disclosures in relation to impacts on biodiversity, which will likely also eventually form part of the ISSB’s Standards.

Organisations would do well in the interim to start internally understanding their environmental footprint more broadly in light of international developments around such disclosures and the evident rapid rise in social expectations regarding sustainable development.

Authors

Head of Investigations and Inquiries

Head of Environment and Planning

Lawyer

Tags

This publication is introductory in nature. Its content is current at the date of publication. It does not constitute legal advice and should not be relied upon as such. You should always obtain legal advice based on your specific circumstances before taking any action relating to matters covered by this publication. Some information may have been obtained from external sources, and we cannot guarantee the accuracy or currency of any such information.

Key Contact

Other Contacts

Head of Environment and Planning

Head of Responsible Business and ESG